RBI Approved Loan Apps List 2024: Check the Full List Here. In India, the Reserve Bank of India (RBI) is in charge of overseeing financial institutions and transactions. It grants various banks, NBFCs (Non-Banking Financial Companies), and fintech firms licenses and authorization to provide financial services, including loans. To guarantee that these institutions adhere to regulations, uphold transparency, and safeguard the interests of borrowers, the RBI’s clearance is necessary.

You should search for financial institutions that have the RBI’s approval to provide loan products online if you want to locate RBI-approved loan apps. These could include both conventional banks and NBFCs, in addition to more recent fintech startups that have received the required permits.

RBI Approved Loan Apps List 2024

A mobile application that offers financial services and loans to people and companies is known as an RBI Registered Loan App if it has gained official permission and registration from the Reserve Bank of India (RBI). The RBI carefully examines these applications to make sure they adhere to rules on data protection, privacy, and fair lending practices.

Borrowers may trust the legality and dependability of the platform by using RBI-registered loan applications. Convenience, prompt approval times, competitive borrowing rates, and open terms are all offered by these applications. They also provide a smooth digital experience for credit application submission, document submission, and quick fund disbursal, making borrowing simpler and more accessible for customers. RBI Approved Loan Apps List is the following:

- Kreditbee

- Kreditzy

- Payments

- NAVI

- Lazypay

- Freopay

- Stashfin

- Cashbean

- MI Credit

- Dhani

- Avail Finance

- NIRA

- Branch

- Smartcoin

- Rupeek App

- Simple Pay Later

- Mobikwik

- Paytm Personal Loan

- Krazybee

- Bharatpur

- Paytm Postpaid

- True Caller

- Simply Cash

- Slice

- True Balance

- Zest Money

- Amazon Pay Later

- Flipkart Pay Later

- Tata Capital

- Tata neu Credit card

- Ola Money Pay Later

- Khatabook App

- Jupiter credit limit

- OneCard App

- iMobile Pay Later

- SBI YONO APP

- IDFC Bank Pay later

- Bajaj Finserv App

- Rufilo Loan App

- IBL FINANCE App

- Early Salary

- Money View

- CASHe

- m-Pokket

- Stashfin

- MoneyTap

- FairMoney Loan App

- KreditOne

- FlexSalary Instant Loan App

- DigiMoney

- Indialends

- Kissht

- CreditScore

Top 10 Loan Apps In India

RBI Approved Loan Apps List includes Bajaj Finserv, Money View, CASHe, Paytm, Zest Money, Dhani, Paysense, Kreditbee, and a few other carefully chosen applications. They are among the very few RBI RBI-registered loan apps that are readily available in India. You can Trust These apps For Instant Loans. Check all the best 10 RBI Approved Loan Apps here.

|

NBFC Loan Apps In India

Following are the NBFC NBFC-registered loan Apps In India. Check the full List Below

| App Name | Loan Limit |

| Paysense | 5 lakh |

| Creditbet | – |

| Slice | 1 lakh |

| Truecaller | 5 lakh |

| Paytm postpaid | 1 lakh |

| Rupeek App | 50 lakh |

| Smartcoin | 2 lakh |

| Nira | 2 lakh |

| Mobikwik | 2 lakh |

| Saral Bhugtan bad me | 1 lakh |

| Paytm personal loan | 2 lakh |

| Bharat pay | 5 lakh |

| Credit | 2 lakh |

| Lazype | 1 lakh |

| Cashbean | 1 lakh |

| Steshfin | 5 lakh |

| MI Credit | 5 lakh |

| Navi | 5 lakh |

| Tata New App | 10000 to 10,00,000 |

| Tata capital | 10 lakh |

| Flipkart pay later | 60,000 |

| Amazon Pay | 60,000 |

| Zest Money | 2 lakh |

| Khatabook | 50,000 to 10 lakh |

| Paisabazaar credit limit | 50,000 to 10 lakh |

| Bajaj Finserv App | 50,000 to 5 lakh |

| SBI Yono | 15000 to 60,000 |

| Onecard App | 10,000 to 15000 |

| IBL Finance App | 5000 to 25000 |

| Roofilo Loan App | 5000 to 25000 |

| mPocket | 500 to 30,000 |

| Dizzy Money | 5000 to 25000 |

| Cashe | 1000 to 3,00,000 |

| Fairmoney loan app | 2 lakh |

| Money view | 10,000 to 5,00,000 |

| Creditone | 5000 to 25000 |

| imobile | 20,000 |

RBI Approved Loan Apps Ratings

Here Is the List of Top apps With Their Rating In the Play Store. These Are Some of the Most Popular Apps which Are Used By The Customers

| App Name | Ratings |

| Home Credit | 4.3/5 |

| India Gives Loan | 3.8/5 |

| Cashe | 4.5/5 |

| Money View | 4.6/5 |

| Paysense | 4.1/5 |

| Dhani | 3.8/5 |

| Pay me India | 4.2/5 |

| Money View | 4.6/5 |

RBI Approved Loan Apps List: Features of Personal Loan Apps

The following are the Main Features of Personal Loan Apps In India.

- You can Apply Online Loan Application

- Minimum Documentation Required For KYC

- Fast approval and disbursement of Loan

- The higher loan amount and longer Loan Tenure

- Affordable interest rates & fees

- Easy payment

- Online KYC Verification

RBI Approved Loan Apps 2024 List: Benefits of Using Loan Apps

RBI-approved Loan Apps Are Most Authentic Apps Which Have High Credit Ratings. You can Apply For a Loan. The benefits of These Loan Apps are the Following.

- RBI-approved loan apps are regulated by the Reserve Bank of India.

- They are safe and trustworthy.

- Transparent and fair loan process.

- The Loan apps offer competitive interest rates and flexible reimbursement schedules.

- Easy Loan Process

- No need to Go To the Bank Branch For a Loan. You can Apply From Home.

- Easy KYC Process

How to Check the RBI Registered Loan Apps list online?

Follow This Process To Check the List of all RBI Registered Loan Apps On the Official Website of RBI. Follow The Process Given below

- The official website of the Reserve Bank of India (RBI) Is www.rbi.org.in

- Now Home page Will Appear Before you.

- Now Visit the “Financial Education” or “Consumer Information” sections of the RBI website.

- Next Look at the category or region related to “Enlisted NBFCs” or “Rundown of Approved Advance Applications.”

- Now You Will See a PDF of All Enlisted Apps Which Are Approved By RBI.

- Now Click on the Download Button.

How to Download RBI Registered Loan Apps?

Follow the process Given below. Step by Step Process is Given below To Download the App.

- First Visit the Apple Store or Google Play Store

- Now Search For the Loan App that you Want to Install On Your Smartphone

- Now Click On the Install Button Or Download button

- Now the App is Downloaded on Your Mobile Phone

- In the next Step, Now you Need to Open The app And Create an account.

What Is Eligibility For RBI Registered Loan Apps?

Friends, if you are thinking of taking a loan from the RBI Registered Loan App, then you should have the following qualifications so that you get a good credit limit –

- Applicant must be a citizen of India.

- The minimum age of the applicant should be 21 years and the maximum age should be 60 years.

- There must be a source of income.

- Your CIBIL score should be good.

- You must have a savings account as well as Internet banking.

- Your Aadhaar must be linked to your mobile number.

Note: You should also know whether the app from which you want to take a loan serves your city or not. If you have the qualifications given above, then you can get a loan from any loan application very easily.

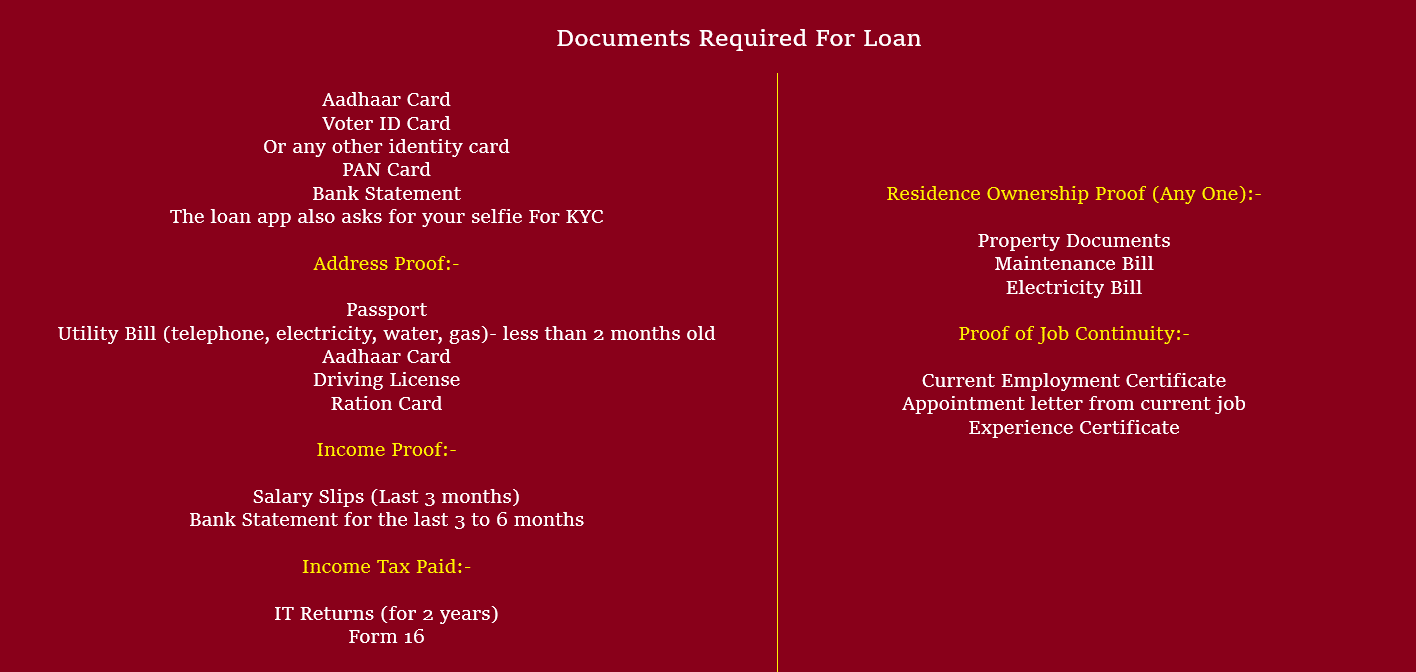

RBI Approved Loan Apps List: Documents For eKYC

The following documents are required for eKYC to take a loan from these apps. Check all documents list below:

If you want to take an online loan from any app from RBI Approved Loan Apps List, then you need to have all the following documents, only then you can apply for an online loan –

- Aadhaar Card

- Voter ID Card

- Or any other identity card

- PAN Card

- Bank Statement

- The loan app also asks for your selfie For KYC

Address Proof:-

- Passport

- Utility Bill (telephone, electricity, water, gas)- less than 2 months old

- Aadhaar Card

- Driving License

- Ration Card

Income Proof:-

- Salary Slips (Last 3 months)

- Bank Statement for the last 3 to 6 months

Income Tax Paid:-

- IT Returns (for 2 years)

- Form 16

Residence Ownership Proof (Any One):-

- Property Documents

- Maintenance Bill

- Electricity Bill

Proof of Job Continuity:-

- Current Employment Certificate

- Appointment letter from current job

- Experience Certificate

Loan Apps Maximum & Minimum Interest Rates

For The customers, We are Providing Interest Rates for all RBI Approved Loan Apps. You can Check All Apps Minimum Interest Rates Which they Charge From Customers. The full List is Given below In the Table.

| App Name | (Minimum) Rate of Interest (p.a.) |

| Navi | 9.90% |

| Money View | 16.00% |

| Kreditbee | 15.00% |

| CASHe | 24.00% |

| Fibe (EarlySalary) | 24.00% |

| NIRA Finance | 24.00% |

| MoneyTap | 12.96% |

| PayMe | 18.00% |

| Privo | 13.49% |

| mPokket | 24.00% |

| InstaMoney | 24.00% |

| True Balance | 28.80% |

| PaySense | 16.00% |

| IIFL Personal Loan | 12.75% |

| Bajaj Finserv | 12.99% |

| Faircent | 18.00% |

| Home Credit | 19.00% |

| LoanTap | 18.00% |

| Finnable | 18.99% |

| IndusInd Bank Personal Loan | 10.49% |

| IIFL Business Loan | 12.75% |

| Kissht | 14.00% |

| Branch Personal Loan Cash Loan App | 24.00% |

| Dhani (Credit Line) | 0.00%-42.00% |

| Stashfin | 11.99% |

| SmartCoin | 0%-30% |

| Indialends | 10.25% |

| India’s Gold Loan | 8.28% |

| Piramal Finance | 11.99% |

| IDFC First Bank (MyFIRST Partner) | 11.00% |

| Rupeek App Gold Loan | 7.08% |

| Buddy Loan | 11.99% |

| FlexSalary Instant Loan App (Credit Line) | 36.00% (Maximum) |

| Tata Capital | 10.99% |

| Hero FinCorp | 25.00% (Maximum) |

| Prefr | 18.00% |

| Kreditzy | 0 – 28.80% |

| 12%Club | |

| ZestMoney (Credit Line) | 3%-35% |

| Paytm Personal Loan | 10.5% |

| Aditya Birla Capital | 14.00% |

| Creditap (Study Loan) | 8.45% |

| Mobikwik (Shopping) | 9.00% |

| Avail Finance | 15.00% |

| FairMoney | 12.00% |

| L&T Finance | 11.00% |

| Upwards | 16.00% |

| LazyPay | 12.00% |

| CreditScore, CreditCard, Loans | 10.99% |

| Fast Cash Loan | 14.00% |

| Loanfront | 15.95% |

| Fedfina loans | 11.88% |

| Fullerton India mConnect | 8.00% |

| Groww | 12.00% |

| Loan Planet | 18.25% |

RBI Loan Apps list 2024: Loan Apps Limit

Some of the Best Loan Apps That are Trusted by RBI Are given below:

| Loan Apps Name | Loan Credit Limit |

| PaySense | Up to 5 Lakhs |

| Navi | Up to 5 Lakhs |

| SmartCoin | Up to 1 Lakhs |

| Freeo Pay | Rs. 10,000 |

| Dhani | Up to 5 Lakhs |

| Paytm personal loan | Upto 2 Lakhs |

| Mobikwik | Upto 2 Lakhs |

| Rupeek App | Upto 50 Lakhs |

| KrazyBee | Upto 2 Lakhs |

| BharatPe | Upto 5 Lakhs |

| True Caller | Upto 5 Lakhs |

| Amazon Pay Later | Upto 60,000 |

| Tata Capital | Above 10 Lakhs |

| SBI YONO App | Upto 60,000 |

| Bajaj Finserv | Upto 5 Lakhs |

| IDFC Bank Pay Later | Upto 60,000 |

| IBL Finance App | Upto 25,000 |

| Mystro Loans and Neo Banking App | Rs. 50,000 |

| KreditBee | Upto 2 Lakhs |

FAQ: RBI Approved Loan Apps List 2024

Which Loan Apps Are Approved By RBI?

Ans: The following Apps Are Approved By RBI

- Money View

- Paysense

- Money Tap

- Bajaj Finserv

- Navi

- NIRA

- Kreditbee

- CASHe

- Zest Money

- Paytm

Which Loan Apps are Legal in India?

Ans: All such loan Apps that have been approved by the Reserve Bank of India and the Central Government are legal in India.

Is Nira App Approved by RBI?

Ans: Nira Finance is a very good application for a personal loan that is RBI-approved.

Is Rufilo App RBI Registered?

Ans: ye sIt is approved By RBI. When you go to the official website of the Rufilo App and read about its policy, you will see that it has been registered by the Reserve Bank of India.

Is MobiKwik approved by RBI?

Ans: MobiKwik is a fully RBI-approved application on which you can take a loan of up to Rs 30000.

Is CreditBee Approved by RBI?

Ans: Yes it is approved by RBI, Creditbee is the most popular application for personal loans, which can be taken from ₹10000 to ₹300000. This has also been approved by the Reserve Bank of India.

Is Navi Loan App RBI Approved?

Ans: Yes it is registered and regulated by the RBI With this app, you can take a loan up to a maximum of ₹2000000.