RBI Approved Loan Apps List 2025: Check the Full List Here. In India, the Reserve Bank of India (RBI) is responsible for overseeing financial institutions and transactions. It grants various banks, NBFCs (non-banking financial companies), and fintech firms licenses and authorizations to provide financial services, including loans. To guarantee that these institutions adhere to regulations, uphold transparency, and safeguard the interests of borrowers, the RBI’s clearance is necessary.

You should search for financial institutions that have the RBI’s approval to provide loan products online if you want to locate RBI-approved loan apps. These could include both conventional banks and NBFCs, in addition to more recent fintech startups that have received the required permits.

RBI Approved Loan Apps List 2025

A mobile application that offers financial services and loans to people and companies is known as an RBI Registered Loan App if it has gained official permission and registration from the Reserve Bank of India (RBI). The RBI carefully examines these applications to make sure they adhere to rules on data protection, privacy, and fair lending practices.

Borrowers may trust the legality and dependability of the platform by using RBI-registered loan applications These applications offer convenience, prompt approval times, competitive borrowing rates, and open terms. They also provide a smooth digital experience for credit application submission, document submission, and quick fund disbursal, making borrowing simpler and more accessible for customers. The following is a list of RBI-approved loan apps:

- Kreditbee

- Kreditzky

- Payments

- NAVI

- Lazypay

- FreePay

- Stashfin

- Cashbean

- MI Credit

- Dhani

- Avail Finance

- NIRA

- Branch

- Smartcoin

- Rupeek App

- Simple Pay Later

- Mobikwik

- Paytm Personal Loan

- Krazybee

- Bharatpur

- Paytm Postpaid

- TrueCaller

- Simply Cash

- Slice

- True Balance

- ZestMoney

- Amazon Pay Later

- Flipkart Pay Later

- Tata Capital

- Tata neu Credit card

- Ola Money Pay Later

- Khatabook App

- Jupiter credit limit

- OneCard App

- iMobile Pay Later

- SBI YONO APP

- IDFC Bank Pay later

- Bajaj Finserv App

- Rufilo Loan App

- IBL FINANCE App

- Early Salary

- Money View

- CASHe

- m-Pokket

- Stashfin

- MoneyTap

- FairMoney Loan App

- KreditOne

- FlexSalary Instant Loan App

- DigiMoney

- Indialends

- Kissht

- CreditScore

Top 10 RBI-Approved Loan Apps In India

The RBI Approved Loan Apps List includes Bajaj Finserv, Money View, CASHe, Paytm, Zest Money, Dhani, Paysense, Kreditbee, and a few other carefully chosen applications. They are among the very few RBI-registered loan apps that are readily available in India. You can trust these apps for instant loans. Please review the top 10 RBI-approved loan apps available here.

|

List of Top-Rated RBI Approved Loan Apps in India 2025

| Loan App Names | Ratings |

| NoBroker Instacash | 5.0/5 |

| Bajaj Finserv | 4.8/5 |

| MoneyView | 4.8/5 |

| SmartCoin | 4.6/5 |

| EarlySalary | 4.5/5 |

| Kreditbee | 4.5/5 |

| Home Credit | 4.5/5 |

| Buddy Loan | 4.4/5 |

| CASHe | 4.4/5 |

| FlexSalary | 4.4/5 |

| LazyPay | 4.4/5 |

| TrueBalance | 4.4/5 |

| Nira Finance | 4.2/5 |

| MoneyTap | 4/5 |

| IndiaLends | 3.9/5 |

| StashFin | 3.8/5 |

| PayMe | 3.5/5 |

| Dhani | 3.3/5 |

| LoanTap | 3.1/5 |

| PaySense | 3/5 |

NBFC Loan Apps In India

The following are the NBFC-registered loan apps in India. Check the full List Below

| App Name | Loan Limit |

| Paysense | 5 lakh |

| Creditbet | – |

| Slice | 1 lakh |

| Truecaller | 5 lakh |

| Paytm postpaid | 1 lakh |

| Rupeek App | 50 lakh |

| Smartcoin | 2 lakh |

| Nira | 2 lakh |

| Mobikwik | 2 lakh |

| Saral Bhugtan bad me | 1 lakh |

| Paytm personal loan | 2 lakh |

| BharatPay | 5 lakh |

| Credit | 2 lakh |

| Lazype | 1 lakh |

| Cashbean | 1 lakh |

| Steshfin | 5 lakh |

| MI Credit | 5 lakh |

| Navi | 5 lakh |

| Tata New App | 10000 to 1000000 |

| Tata capital | 10 lakh |

| Flipkart pay later | 60,000 |

| Amazon Pay | 60,000 |

| ZestMoney | 2 lakh |

| Khatabook | 50,000 to 10 lakh |

| Paisabazaar credit limit | 50,000 to 10 lakh |

| Bajaj Finserv App | 50,000 to 500,000 lakh |

| SBI Yono | 15,000 to 60,000 |

| Onecard App | 10,000 to 15,000 |

| IBL Finance App | 5000 to 25000 |

| Roofilo Loan App | 5000 to 25000 |

| mPocket | 500 to 30,000 |

| Dizzy Money | 5000 to 25000 |

| Cache | 1000 to 300,000 |

| Fairmoney loan app | 2 lakh |

| Money view | 10,000 to $5,000 |

| Creditone | 5000 to 25000 |

| immobile | 20,000 |

RBI Approved Loan Apps Ratings

Here is the list of top apps with their ratings in the Play Store. These Are Some of the Most Popular Apps which Are Used By The Customers

| App Name | Ratings |

| Home Credit | 4.3/5 |

| India Gives Loan | 3.8/5 |

| Cache | 4.5/5 |

| Money View | 4.6/5 |

| Paysense | 4.1/5 |

| Dhani | 3.8/5 |

| Pay me India | 4.2/5 |

| Money View | 4.6/5 |

RBI Approved Loan Apps List: Features of Personal Loan Apps

The following are the main features of personal loan apps in India.

- You can Apply for an Application

- Minimum Documentation Required For KYC

- Fast approval and disbursement of Loan

- The higher loan amount and longer Loan Tenure

- Affordable interest rates & fees

- Easy payment

- Online KYC Verification

RBI Approved Loan Apps 2025 List: Benefits of Using Loan Apps

RBI-approved loan apps are the most authentic and have high credit ratings. You can apply for a loan. These loan apps offer several benefits.

- RBI-approved loan apps are regulated by the Reserve Bank of India.

- They are safe and trustworthy.

- The loan process is transparent and fair.

- The loan apps offer competitive interest rates and flexible reimbursement schedules.

- Easy Loan Process

- You don’t have to visit the bank branch to apply for a loan. You can apply from home.

- Easy KYC Process

How to Check the RBI Registered Loan Apps List Online?

Follow this process to check the list of all RBI-registered loan apps on the official website of the RBI. Follow The Process Given below

- The official website of the Reserve Bank of India (RBI) Is www.rbi.org.in

- Now the home page will appear before you.

- Now Visit the “Financial Education” or “Consumer Information” sections of the RBI website.

- Next, look at the category or region related to “enlisted NBFCs” or “rundown of approved advance applications.”

- Now you will see a PDF of all enlisted apps that are approved by RBI.

- Now click on the download button.

How to Download RBI-Registered Loan Apps?

Follow the process given below. Below is a step-by-step process for downloading the app.

- First Visit the Apple Store or Google Play Store

- Now Search For the Loan App that you Want to Install On Your Smartphone

- Now Click On the Install Button Or Download button

- Now the App is Downloaded on Your Mobile Phone

- In the next step, now you need to open the app and create an account.

What Is Eligibility for RBI-Registered Loan Apps?

Friends, if you are thinking of taking a loan from the RBI Registered Loan App, then you should have the following qualifications so that you get a favorable credit limit:

- The applicant must be a citizen of India.

- The minimum age of the applicant should be 21 years, and the maximum age should be 60 years.

- There must be a source of income.

- Your CIBIL score should be good.

- You must have a savings account as well as Internet banking.

- Your Aadhaar must be linked to your mobile number.

Note: You should also know whether the app from which you want to take a loan serves your city or not. If you have the qualifications given above, then you can get a loan from any loan application effortlessly.

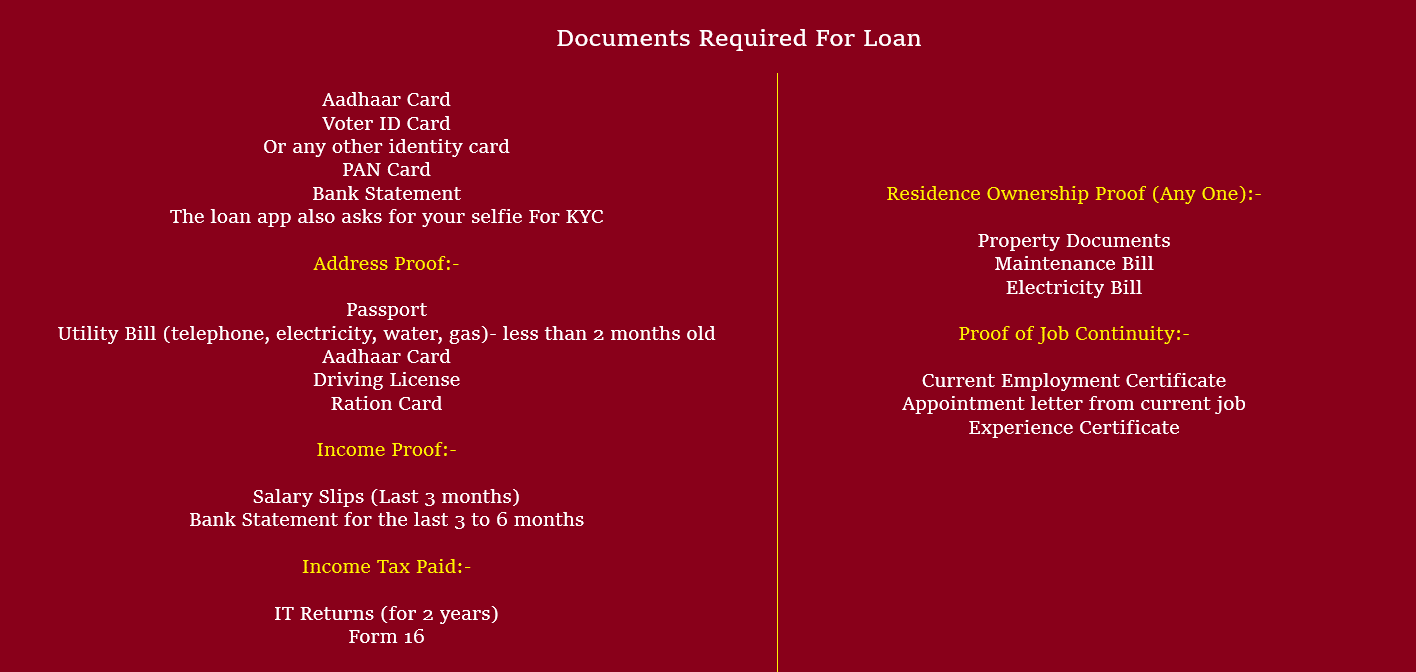

RBI Approved Loan Apps List: Documents For eKYC

The following documents are required for eKYC to take a loan from these apps. Check all documents listed below:

If you want to take an online loan from any app from the RBI Approved Loan Apps List, then you need to have all the following documents; only then can you apply for an online loan:

- Aadhaar Card

- Voter ID Card

- Or any other identity card

- PAN Card

- Bank Statement

- The loan app also asks for your selfie For KYC

Address Proof:

- Passport

- Utility Bill (telephone, electricity, water, gas)- less than 2 months old

- Aadhaar Card

- Driver’s License

- Ration Card

Income Proof:

- Salary Slips (Last 3 months)

- Bank Statement for the last 3 to 6 months

Income Tax Paid:

- IT Returns (for 2 years)

- Form 16

Residence Ownership Proof (Any One):

- Property Documents

- Maintenance Bill

- Electricity Bill

Proof of job continuity:

- Current Employment Certificate

- Appointment letter from current job

- Experience Certificate

RBI Approved Loan Apps Maximum & Minimum Interest Rates

For the customers, we are providing interest rates for all RBI-approved loan apps. You can check all apps minimum interest rates that they charge from customers. The table below provides the complete list.

| App Name | (Minimum) Rate of Interest (p.a.) |

| Navi | 9.90% |

| Money View | 16.00% |

| Kreditbee | 15.00% |

| CASHe | 24.00% |

| Fibe (EarlySalary) | 24.00% |

| NIRA Finance | 24.00% |

| MoneyTap | 12.96% |

| PayMe | 18.00% |

| Privo | 13.49% |

| mPokket | 24.00% |

| InstaMoney | 24.00% |

| True Balance | 28.80% |

| PaySense | 16.00% |

| IIFL Personal Loan | 12.75% |

| Bajaj Finserv | 12.99% |

| Faircent | 18.00% |

| Home Credit | 19.00% |

| LoanTap | 18.00% |

| Finnable | 18.99% |

| IndusInd Bank Personal Loan | 10.49% |

| IIFL Business Loan | 12.75% |

| Kissht | 14.00% |

| Branch Personal Loan Cash Loan App | 24.00% |

| Dhani (Credit Line) | 0.00%-42.00% |

| Stashfin | 11.99% |

| SmartCoin | 0%-30% |

| Indialends | 10.25% |

| India’s Gold Loan | 8.28% |

| Piramal Finance | 11.99% |

| IDFC First Bank (MyFIRST Partner) | 11.00% |

| Rupeek App Gold Loan | 7.08% |

| Buddy Loan | 11.99% |

| FlexSalary Instant Loan App (Credit Line) | 36.00% (Maximum) |

| Tata Capital | 10.99% |

| Hero FinCorp | 25.00% (Maximum) |

| Prefer | 18.00% |

| Kreditzky | 0–28.80% |

| 12 | |

| ZestMoney (Credit Line) | 3%-35% |

| Paytm Personal Loan | 10.5% |

| Aditya Birla Capital | 14.00% |

| Creditap (Study Loan) | 8.45% |

| Mobikwik (Shopping) | 9.00% |

| Avail Finance | 15.00% |

| FairMoney | 12.00% |

| L&T Finance | 11.00% |

| Upwards | 16.00% |

| LazyPay | 12.00% |

| CreditScore, CreditCard, Loans | 10.99% |

| Fast Cash Loan | 14.00% |

| Loanfront | 15.95% |

| Fedfina loans | 11.88% |

| Fullerton India mConnect | 8.00% |

| Grow | 12.00% |

| Loan Planet | 18.25% |

RBI Loan Apps list 2025: Loan Apps Limit

Some of the best loan apps trusted by the RBI are listed below:

| Loan Apps Name | Loan Credit Limit |

| PaySense | Up to 5 Lakhs |

| Navi | Up to 5 Lakhs |

| SmartCoin | Up to 1 lakh |

| FreePay | Rs. 10,000 |

| Dhani | Up to 5 Lakhs |

| Paytm personal loan | to 2 Lakhs |

| Mobikwik | to 2 Lakhs |

| Rupeek App | to 50 Lakhs |

| KrazyBee | Upto Lakhs |

| BharatPe | to 5 Lakhs |

| TrueCaller | to 5 Lakhs |

| Amazon Pay Later | to 60,000 |

| Tata Capital | Above 10 Lakhs |

| SBI YONO App | to 60,000 |

| Bajaj Finserv | to 5 Lakhs |

| IDFC Bank Pay Later | to 60,000 |

| IBL Finance App | to 25,000 |

| Mystro Loans and Neo Banking App | Rs. 50,000 |

| KreditBee | to 2 Lakhs |

FAQ: RBI Approved Loan Apps List 2025

Which Loan Apps Are Approved By RBI?

Ans: The following Apps Are Approved By RBI

- Money View

- Paysense

- MoneyTap

- Bajaj Finserv

- Navi

- NIRA

- Kreditbee

- CASHe

- ZestMoney

- Paytm

Which Loan Apps Are Legal in India?

Ans: The Reserve Bank of India and the central government have approved all such loan apps, making them legal in India.

Is the Nira app approved by RBI?

Ans: Nira Finance is a fantastic application for a personal loan that is RBI-approved.

Is Rufilo App RBI Registered?

Yes, the RBI has approved it. The Reserve Bank of India has registered the Rufilo App, as stated on its official website.

Is MobiKwik approved by RBI?

Ans: MobiKwik is a fully RBI-approved application on which you can take a loan of up to Rs 30000.

Is CreditBee approved by RBI?

Yes, RBI has approved it. Creditbee is the most popular application for personal loans, which can be taken from ₹10000 to ₹300000. The application has also been approved by the Reserve Bank of India.

Is the Navi Loan App RBI Approved?

Ans: Yes, it is registered and regulated by the RBI With this app, you can take a loan up to a maximum of ₹2000000.