Adani Shares List 2024: Price, Hindenburg Report Effect on Adani. The Adani Group, founded by Gautam Adani in 1988, is a prominent Indian multinational conglomerate headquartered in Ahmedabad. The group has a diverse portfolio, including sectors such as transport logistics, renewable energy, port management, airport operations, electric power generation, food processing, mining, and oil and gas supply.

Adani Enterprises Limited (AEL), the flagship company, is primarily involved in the mining and trading of coal and iron ore. As of August 2024, AEL’s stock price stands at ₹3,224 with a market capitalization of ₹367,023.36 crore. Other notable companies in the group include Adani Ports & Special Economic Zone Ltd, Adani Green Energy Ltd, Adani Power Ltd, and Adani Wilmar Ltd.

The Adani Group emphasizes sustainable growth and community-focused initiatives, promoting the notion of “Growth with Goodness.” The group’s total market cap of its seven publicly traded entities exceeds ₹3.77 lakh crore. Despite market fluctuations, Adani shares have provided lucrative returns to investors, making them a popular choice for those seeking stable investments.

Adani Shares List 2024

| Company Name | Ticker Symbol | Sector | Current Share Price (₹) | Market Capitalization (₹ Crore) |

|---|---|---|---|---|

| Adani Enterprises Limited (AEL) | ADANIENT | Mining & Trading | 3,224 | 367,023.36 |

| Adani Ports & Special Economic Zone Ltd | ADANI PORTS | Port Management | 764.50 | 156,000.00 |

| Adani Green Energy Ltd | ADANIGREEN | Renewable Energy | 1,020 | 160,000.00 |

| Adani Power Ltd | ADANI POWER | Electric Power Generation | 270.50 | 104,000.00 |

| Adani Wilmar Ltd | AWL | Food Processing | 570.00 | 74,000.00 |

| Adani Transmission Ltd | ADANITRANS | Electric Power Transmission | 1,200 | 132,000.00 |

| Adani Total Gas Ltd | ATGL | Natural Gas Distribution | 850.00 | 93,000.00 |

About Adani

The Adani Group, founded by Gautam Adani in 1988, has grown into one of India’s largest and most influential multinational conglomerates. Headquartered in Ahmedabad, Gujarat, the group has diversified its operations across various sectors, including transport logistics, renewable energy, port management, airport operations, electric power generation, food processing, mining, and oil and gas supply.

| Founded | 1988 |

| Founder | Gautam Adani |

| Headquarters | Ahmedabad, Gujarat, India |

| Industry | Conglomerate |

| Revenue (2024) | ₹9.32 lakh crore (US$110 billion) |

| Net Income (2024) | ₹42,396 crore (US$5.1 billion) |

| Number of Employees (2024) | ~43,000+ |

| Key People | Gautam Adani (Chairman) |

| Major Subsidiaries |

|

| Primary Business Areas | Port management, Electric power, Mining, Renewable energy, Airport operations, Oil and gas, Food processing, Infrastructure |

| Market Capitalization (2024) | Over $200 billion |

| Major Controversies | Allegations of stock manipulation, accounting irregularities, political corruption, cronyism, tax evasion, environmental damage, and suing journalists |

| Hindenburg Report Impact | Lost over $104 billion in market value, later recovered to over $200 billion |

| Supreme Court Involvement | Directed SEBI to expedite the investigation, cleared Adani Group from further probes in the Hindenburg saga |

| Environmental Initiatives | Investments in renewable energy projects |

| Major Ports Operated | Mundra Port (largest private port in India) |

| Coal Business | Largest coal importer in India |

| International Presence | Operations in multiple countries |

| Recent Developments | New allegations involving SEBI Chairperson and offshore funds |

| Stock Performance | Significant fluctuations due to market and legal developments |

| Philanthropy | Adani Foundation involved in various social initiatives |

| Major Acquisitions | Bunyu Mine in Indonesia, Ambuja Cements, ACC |

| Renewable Energy Projects | Significant investments in solar and wind energy |

| Airport Operations | Managing several major airports in India |

| Oil and Gas Exploration | Active in exploration and production |

| Food Processing | Joint venture in edible oil refining (Adani Wilmar) |

| Infrastructure Projects | Involved in various large-scale infrastructure projects |

| Media Ownership | Acquired NDTV |

| Sports Investments | Owns Gujarat Titans (IPL team) |

| Future Plans | Expansion in renewable energy, infrastructure, and international markets |

Adani Shares List 2024: Adani Enterprises Limited (AEL)

- Ticker Symbol: ADANIENT

- Sector: Mining & Trading

- Current Share Price: ₹3,224

- Market Capitalization: ₹367,023.36 crore

- Key Facts: Flagship company, involved in coal and iron ore mining and trading.

Adani Ports & Special Economic Zone Ltd

- Ticker Symbol: ADANIPORTS

- Sector: Port Management

- Current Share Price: ₹764.50

- Market Capitalization: ₹156,000.00 crore

- Key Facts: Largest commercial port operator in India.

Adani Green Energy Ltd

- Ticker Symbol: ADANIGREEN

- Sector: Renewable Energy

- Current Share Price: ₹1,020

- Market Capitalization: ₹160,000.00 crore

- Key Facts: Focuses on renewable energy projects, including solar and wind power.

Adani Power Ltd

- Ticker Symbol: ADANIPOWER

- Sector: Electric Power Generation

- Current Share Price: ₹270.50

- Market Capitalization: ₹104,000.00 crore

- Key Facts: Engaged in power generation and distribution.

Adani Wilmar Ltd

- Ticker Symbol: AWL

- Sector: Food Processing

- Current Share Price: ₹570.00

- Market Capitalization: ₹74,000.00 crore

- Key Facts: Joint venture with Wilmar International, involved in edible oil and food products.

Adani Transmission Ltd

- Ticker Symbol: ADANITRANS

- Sector: Electric Power Transmission

- Current Share Price: ₹1,200

- Market Capitalization: ₹132,000.00 crore

- Key Facts: Operates and maintains electric power transmission systems.

Adani Total Gas Ltd

- Ticker Symbol: ATGL

- Sector: Natural Gas Distribution

- Current Share Price: ₹850.00

- Market Capitalization: ₹93,000.00 crore

- Key Facts: Joint venture with TotalEnergies, focuses on natural gas distribution.

Adani Shares List 2024: Additional Facts

- Adani Group’s Total Market Cap: The combined market capitalization of the seven publicly traded entities exceeds ₹3.77 lakh crore.

- Sustainability Initiatives: The group emphasizes sustainable growth and community-focused initiatives, promoting “Growth with Goodness.”

- Global Presence: Adani Group has a significant global presence, with operations in multiple countries across various sectors.

Sustainability and Community Initiatives

The Adani Group emphasizes sustainable growth and community-focused initiatives, promoting the notion of “Growth with Goodness.” The group has undertaken various projects aimed at improving the quality of life for communities, including education, healthcare, and infrastructure development.

Global Presence and Future Prospects

With a significant global presence, the Adani Group operates in multiple countries, expanding its influence and contributing to global economic growth. The group’s total market capitalization of its seven publicly traded entities exceeds ₹3.77 lakh crore, reflecting its robust financial health and investor confidence.

Adani and Hindenburg Case

The Adani-Hindenburg case has been a significant topic in the financial world. Here’s a brief overview:

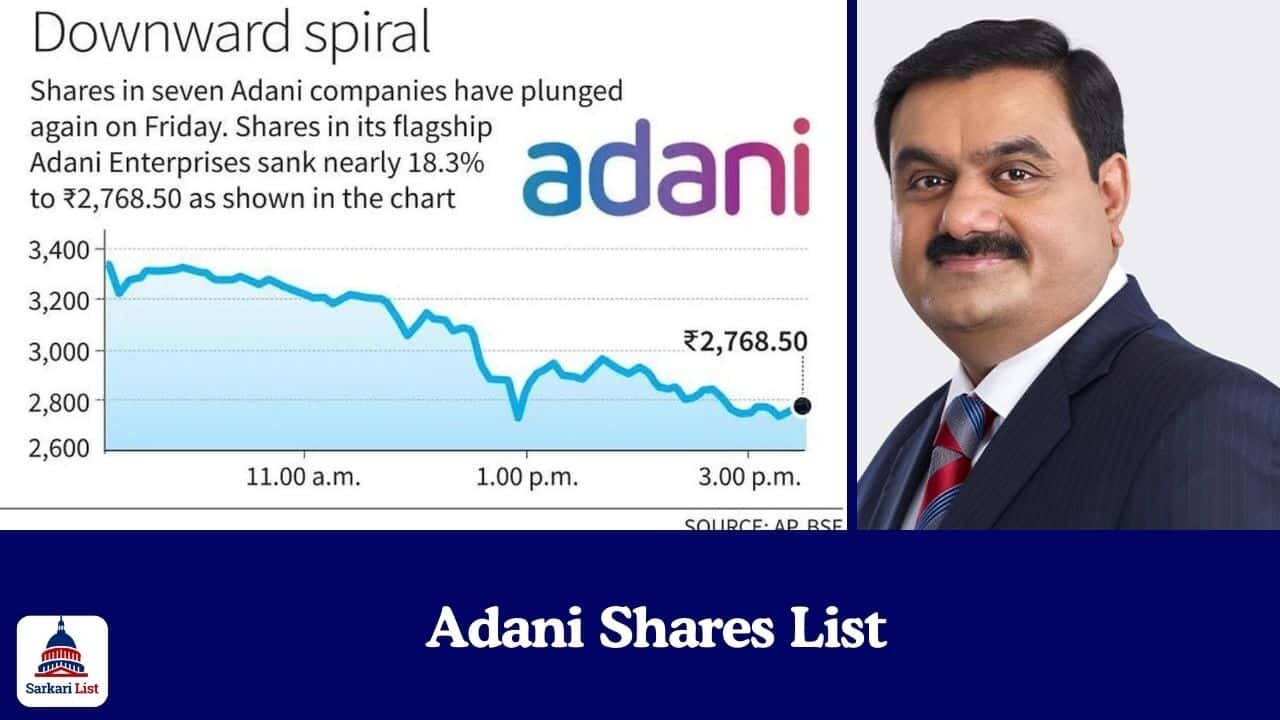

Initial Allegations: In January 2023, Hindenburg Research, a US-based short-seller, published a report accusing the Adani Group of “brazen stock manipulation and accounting fraud” over several decades. This led to a massive sell-off in Adani Group stocks, wiping out over $100 billion in market value.

Adani Group’s Response: The Adani Group strongly denied the allegations, calling them “malicious” and “manipulative”. They argued that the report was an attack on India and its institutions.

Legal Proceedings: The case reached the Supreme Court of India, which cleared the Adani Group of conflict of interest claims but directed the Securities and Exchange Board of India (SEBI) to investigate the allegations further. The court also rejected calls for a Special Investigation Team (SIT) to take over the probe.

Recent Developments: As of August 2024, new allegations have surfaced involving SEBI Chairperson Madhabi Puri Buch and her husband, Dhaval Buch, regarding hidden investments in offshore funds tied to Adani45. The Adani Group has denied any commercial relationship with the individuals mentioned.

Conclusion

The Adani Group’s journey from a small trading firm to a global conglomerate is a testament to its visionary leadership, strategic diversification, and commitment to sustainable growth. As the group continues to expand its horizons, it remains a key player in shaping India’s economic landscape and contributing to global development.